Exploring the realm of Progressive Commercial Auto Insurance: Cost vs Value, this piece sets the stage for a comprehensive dive into the intricacies of pricing and benefits, aiming to shed light on the optimal balance businesses seek in their insurance coverage.

Delve into the specifics of coverage options and real-life examples where Progressive shines in providing exceptional value to businesses.

Cost of Progressive Commercial Auto Insurance

When it comes to the cost of Progressive commercial auto insurance, several factors come into play that influence the premiums that businesses have to pay. The pricing structure of Progressive commercial auto insurance is competitive, but it’s essential to understand how businesses can potentially lower their premiums and save on costs.

Factors Influencing Cost

- Business Location: The location of the business plays a significant role in determining insurance premiums. Urban areas with higher traffic congestion and crime rates may result in higher premiums.

- Type of Vehicles: The type of vehicles being insured, including their make, model, and usage, can impact the cost of insurance. Commercial trucks or vehicles with specialized equipment may have higher premiums.

- Driving Record: The driving record of the business and its drivers can affect insurance costs. A history of accidents or traffic violations may lead to higher premiums.

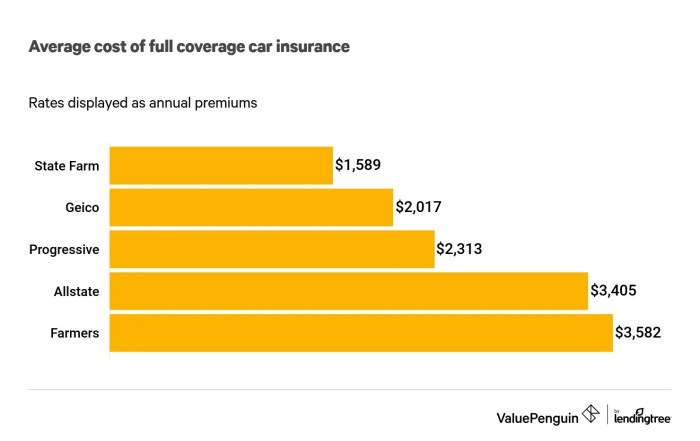

Comparison with Competitors

- Progressive offers competitive pricing compared to other commercial auto insurance providers in the market. They provide customizable coverage options tailored to the specific needs of businesses.

- Businesses can compare quotes from multiple insurance companies to ensure they are getting the best value for their money. Factors such as coverage limits, deductibles, and additional services should be considered when comparing prices.

Tips to Lower Premiums

- Implementing safety measures such as driver training programs and installing safety devices in vehicles can help reduce the risk of accidents and lower insurance premiums.

- Bundling commercial auto insurance with other policies, such as general liability or property insurance, may result in discounts from Progressive.

- Maintaining a clean driving record and reviewing coverage limits regularly can also help businesses save on insurance costs with Progressive.

Value of Progressive Commercial Auto Insurance

When it comes to the value of commercial auto insurance, Progressive stands out for its comprehensive coverage options and exceptional benefits for businesses. Let’s delve into the specifics of why choosing Progressive can provide significant value for your commercial vehicle needs.

Coverage Options Provided by Progressive

- Liability Coverage: Protects your business from financial losses in the event of bodily injury or property damage caused by your commercial vehicle.

- Collision Coverage: Covers the cost of repairs or replacement of your vehicle in case of a collision, regardless of fault.

- Comprehensive Coverage: Provides protection against non-collision incidents such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Safeguards your business if you’re involved in an accident with a driver who lacks sufficient insurance coverage.

Benefits of Choosing Progressive

- Customizable Policies: Progressive offers flexible policy options tailored to your business’s specific needs and budget.

- Dedicated Customer Support: Access to 24/7 customer service and claims support to ensure a smooth experience in the event of an accident.

- Competitive Rates: Progressive’s pricing is competitive in the market, providing value without compromising on coverage.

Real-Life Scenarios of Exceptional Value

One business owner shared how Progressive’s quick claims process helped get their vehicle back on the road in no time after an accident, minimizing downtime and loss of income.

Another testimonial highlighted how Progressive’s comprehensive coverage saved their business from significant financial strain after a major collision that would have otherwise been devastating.

Cost vs Value Comparison

When comparing the cost and value aspects of Progressive commercial auto insurance, it is essential to analyze how the pricing aligns with the benefits offered by the policy. Let’s delve into the key differences in cost and value between Progressive and traditional commercial auto insurance.

Cost Comparison

- Progressive may offer competitive rates for commercial auto insurance policies compared to traditional insurers.

- Progressive’s pricing structure may be more flexible, allowing businesses to customize coverage options based on their needs.

- Traditional commercial auto insurance companies may have higher premiums due to their established reputation and overhead costs.

Value Comparison

- Progressive provides a range of benefits such as 24/7 customer service, discounts for safe driving, and innovative tools like the Snapshot program.

- Traditional commercial auto insurance companies may offer more personalized service but could lack the technological advancements and convenience that Progressive provides.

- Progressive’s focus on digital solutions and ease of use may appeal to businesses looking for efficient insurance management.

Analysis

When assessing whether the cost aligns with the value offered by Progressive commercial auto insurance, businesses must consider their specific needs and priorities. While Progressive may offer competitive pricing, the value of their service, including convenience and innovative tools, could justify the cost for many businesses.

Final Thoughts

In conclusion, the analysis of cost versus value in Progressive Commercial Auto Insurance leads us to a nuanced understanding of how businesses can make informed decisions to protect their assets effectively. As the landscape of commercial insurance evolves, Progressive stands out as a reliable ally in navigating these waters.

Popular Questions

What factors influence the cost of Progressive Commercial Auto Insurance?

The cost of Progressive Commercial Auto Insurance is influenced by factors such as the type of coverage selected, the business’s location, driving history, and the number of vehicles insured.

How can businesses lower their premiums with Progressive Commercial Auto Insurance?

Businesses can potentially lower their premiums by taking advantage of discounts offered by Progressive, maintaining a clean driving record, bundling policies, and implementing safety measures for their vehicles.

What are some key differences in cost and value between Progressive and traditional commercial auto insurance?

Progressive often offers more flexible coverage options and competitive pricing compared to traditional commercial auto insurance providers. Additionally, Progressive’s focus on technology and innovation sets it apart in providing tailored solutions for businesses.