Exploring the realm of Business Insurance for LLCs: What It Covers and Why It Matters, this introduction sets the stage for an insightful journey into the importance of insurance coverage for LLCs.

The following paragraph will delve into the specifics of various insurance types and their relevance to LLCs.

Overview of Business Insurance for LLCs

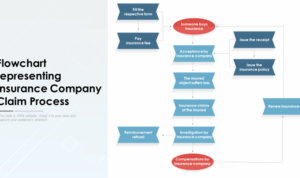

Business insurance for Limited Liability Companies (LLCs) is a crucial component of risk management for these types of entities. It is a type of insurance specifically designed to protect LLCs from potential financial losses resulting from lawsuits, property damage, liability claims, and other unforeseen events.LLCs need specific insurance coverage because they operate as separate legal entities from their owners, providing liability protection for the owners’ personal assets.

Without adequate insurance, LLC owners risk losing their personal assets in the event of a lawsuit or other liabilities.

Common Types of Insurance for LLCs

- General Liability Insurance: Provides coverage for third-party bodily injury, property damage, and advertising injury claims.

- Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, it covers claims related to professional services or advice provided by the LLC.

- Property Insurance: Protects the LLC’s physical assets, including buildings, equipment, and inventory, from damage or loss due to covered perils like fire, theft, or vandalism.

- Workers’ Compensation Insurance: Mandatory in most states, this insurance provides benefits to employees who are injured or become ill during the course of their employment.

- Business Interruption Insurance: Helps cover lost income and expenses if the LLC is unable to operate due to a covered peril, such as a fire or natural disaster.

Importance of Business Insurance for LLCs

Business insurance is essential for LLCs to protect their assets and mitigate various risks that can impact their operations. Without adequate insurance coverage, an LLC can be vulnerable to financial losses and legal liabilities that may arise from unexpected events.

Risks Mitigated by Business Insurance

- Property Damage: Insurance can help cover the costs of repairing or replacing property damaged by fire, theft, or natural disasters.

- Liability Claims: Insurance can protect an LLC from lawsuits related to injuries, negligence, or other claims made by third parties.

- Business Interruption: Insurance can provide financial support if a business is unable to operate due to unforeseen circumstances.

Protection of LLC Assets

Having insurance can safeguard an LLC’s assets, including property, equipment, inventory, and intellectual property, from potential risks. In the event of a covered loss, insurance can help ensure that the LLC can continue its operations without facing significant financial burdens.

Significant Difference in Scenarios

- If a customer slips and falls on the premises of an LLC, resulting in a lawsuit, liability insurance can help cover legal expenses and potential settlements.

- In the case of a fire damaging the office space of an LLC, property insurance can assist in rebuilding and replacing essential equipment to resume business operations.

- When a key employee of an LLC becomes ill and is unable to work, disability insurance can provide income replacement to maintain business continuity.

Types of Coverage Offered by Business Insurance for LLCs

When it comes to protecting your LLC, having the right insurance coverage is crucial. Here are some of the key types of coverage offered by business insurance for LLCs:

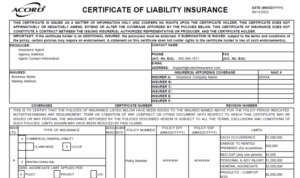

General Liability Insurance

General liability insurance provides coverage for legal costs, medical expenses, and damages if your LLC is sued for bodily injury, property damage, or advertising injury. This type of insurance can help protect your business from financial losses due to lawsuits.

- General liability insurance covers third-party bodily injury and property damage claims.

- It also provides coverage for libel, slander, and copyright infringement claims.

- Having general liability insurance can help give your LLC credibility and show clients that you are a reliable business.

Property Insurance

Property insurance is essential for LLCs that own or lease physical space, equipment, or inventory. This type of insurance provides coverage for damage or loss to your business property due to fire, theft, vandalism, or other covered perils. Property insurance can help your LLC recover quickly in the event of a disaster.

- Property insurance can cover buildings, equipment, inventory, and other physical assets owned by your LLC.

- It can also provide coverage for business interruption, helping your LLC continue operating after a covered loss.

- Having property insurance can give you peace of mind knowing that your business assets are protected.

Worker’s Compensation Insurance

Worker’s compensation insurance is mandatory in most states for LLCs with employees. This type of insurance provides coverage for medical expenses and lost wages if an employee is injured or becomes ill on the job. Worker’s compensation insurance can help protect your LLC from costly lawsuits and ensure that your employees are taken care of.

- Worker’s compensation insurance covers medical expenses, rehabilitation costs, and lost wages for injured employees.

- It can help your LLC comply with state regulations and avoid penalties for not having adequate coverage.

- Having worker’s compensation insurance can improve employee morale and loyalty, showing that you value their well-being.

Customizing Insurance Policies for LLCs

When it comes to protecting your LLC, having the right insurance coverage is crucial. Tailoring your insurance policies to meet the specific needs of your LLC can help ensure you are adequately protected in case of unforeseen events. Here are some tips on how to customize insurance policies for LLCs:

Assessing Risks

Before customizing your insurance policy, it is essential to assess the risks that your LLC may face. This involves identifying potential threats to your business, such as property damage, liability claims, or loss of income. By understanding the risks, you can determine the appropriate coverage needed to protect your LLC.

Add-On Coverage Options

There are various add-on coverage options that LLCs may consider to enhance their insurance policies. Some examples include:

- Business Interruption Insurance: This coverage can help compensate for lost income and expenses in the event that your business is unable to operate due to a covered peril.

- Cyber Liability Insurance: With the increasing threat of cyber-attacks, this coverage can help protect your LLC from data breaches and other cyber risks.

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage can protect your LLC from claims of professional negligence or failure to perform services.

- Umbrella Insurance: This coverage provides additional liability protection beyond the limits of your primary insurance policies, offering an extra layer of security for your LLC.

By customizing your insurance policies and considering add-on coverage options, you can ensure that your LLC is adequately protected against potential risks and liabilities.

Last Point

Wrapping up our discussion on Business Insurance for LLCs: What It Covers and Why It Matters, we have highlighted the crucial role insurance plays in safeguarding LLCs against potential risks and uncertainties.

Popular Questions

What is business insurance for LLCs?

Business insurance for LLCs provides specific coverage tailored to the needs of limited liability companies, protecting them from various risks and liabilities.

Why do LLCs need specific insurance coverage?

LLCs require specialized insurance to shield their assets from potential legal claims, accidents, or unforeseen circumstances that could jeopardize their operations.

What are some examples of common types of insurance for LLCs?

Common types of insurance for LLCs include general liability insurance, property insurance, and worker’s compensation insurance.

How can insurance protect an LLC’s assets?

Insurance can provide financial coverage in the event of property damage, lawsuits, or employee injuries, safeguarding an LLC’s assets from substantial losses.

What are some scenarios where insurance coverage can make a significant difference for an LLC?

Insurance coverage can be crucial in scenarios like customer injury claims, property damage lawsuits, or employee accidents, where the financial repercussions could be substantial without adequate coverage.