Do You Really Need Business Insurance for Your LLC? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Exploring the importance of business insurance for LLC, the types available, legal requirements, cost considerations, and more will shed light on the significance of protecting your company’s assets.

Importance of Business Insurance for LLC

Business insurance is a crucial component for protecting the assets of your Limited Liability Company (LLC). It provides financial coverage and protection in case of unexpected events that could potentially lead to financial ruin.

Protection of Assets

Having business insurance safeguards your LLC’s assets from risks such as property damage, theft, or lawsuits. In the event of a lawsuit or liability claim, insurance can help cover legal fees, settlements, and damages, protecting your company’s finances.

Financial Stability

Business insurance can save your company from financial ruin by providing coverage for unexpected events like natural disasters, accidents, or business interruptions. Without insurance, the costs associated with these events could cripple your LLC financially.

Risk Management

Without adequate insurance coverage, an LLC may face potential risks and liabilities that could result in significant financial losses. From employee injuries to data breaches, insurance helps mitigate these risks and ensures the long-term stability of your business.

Types of Business Insurance for LLC

Insurance is crucial for protecting your LLC from potential risks and liabilities. Here are the different types of business insurance options available for LLCs:

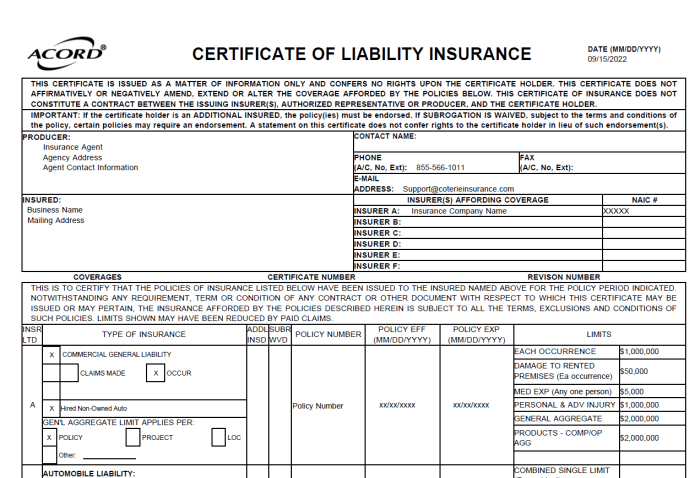

General Liability Insurance

General liability insurance provides coverage for third-party bodily injury, property damage, and advertising injury claims. It helps protect your LLC from lawsuits and financial losses resulting from accidents or negligence.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is essential for service-based businesses. It covers claims of negligence, errors, or omissions in the services provided by your LLC.

Property Insurance

Property insurance protects your LLC’s physical assets, including buildings, equipment, inventory, and furniture, from damages due to fire, theft, vandalism, or natural disasters.

Benefits of Bundling Insurance Policies

Bundling multiple insurance policies, such as general liability, professional liability, and property insurance, can offer several advantages for your LLC:

Bundling insurance policies can lead to cost savings through discounts offered by insurance providers.

It simplifies the insurance management process by having all policies with one insurer.

Bundling can provide comprehensive coverage by filling in any gaps between individual policies.

Legal Requirements and Compliance

In order to ensure the smooth operation of your LLC, it is crucial to understand the legal obligations and requirements for having business insurance in different jurisdictions.

Insurance Requirements for LLCs

- Most states require LLCs to have certain types of insurance, such as workers’ compensation insurance, especially if you have employees.

- Professional liability insurance may be mandatory for certain professions, like doctors or lawyers.

- General liability insurance is often recommended to protect your LLC from lawsuits or claims.

Compliance with Insurance Regulations

- Failure to comply with insurance regulations can result in fines, penalties, or even the suspension of your LLC’s operations.

- Non-compliance can also damage the reputation of your LLC and erode trust with customers, suppliers, and partners.

- By meeting insurance standards, you demonstrate a commitment to responsible business practices and risk management.

Consequences of Non-Compliance

- Not meeting the necessary insurance standards can leave your LLC vulnerable to financial losses in case of accidents, lawsuits, or other unforeseen events.

- Without adequate insurance coverage, your personal assets could be at risk if your LLC is sued or faces legal claims.

- Failure to maintain proper insurance can result in legal liabilities and challenges in securing contracts or partnerships.

Cost Considerations and Budgeting

When it comes to business insurance for your LLC, cost considerations are crucial in managing your budget effectively. The factors that influence the cost of business insurance for an LLC can vary depending on various aspects such as the industry you operate in, coverage limits, and the deductible you choose.

Factors Influencing Insurance Costs

- The industry your LLC operates in plays a significant role in determining insurance costs. High-risk industries may have higher premiums due to the increased likelihood of claims.

- Coverage limits also impact the cost of insurance. Higher coverage limits generally result in higher premiums to ensure adequate protection for your LLC.

- The deductible amount you choose can affect your insurance costs. A higher deductible typically means lower premiums, but you’ll have to pay more out of pocket in the event of a claim.

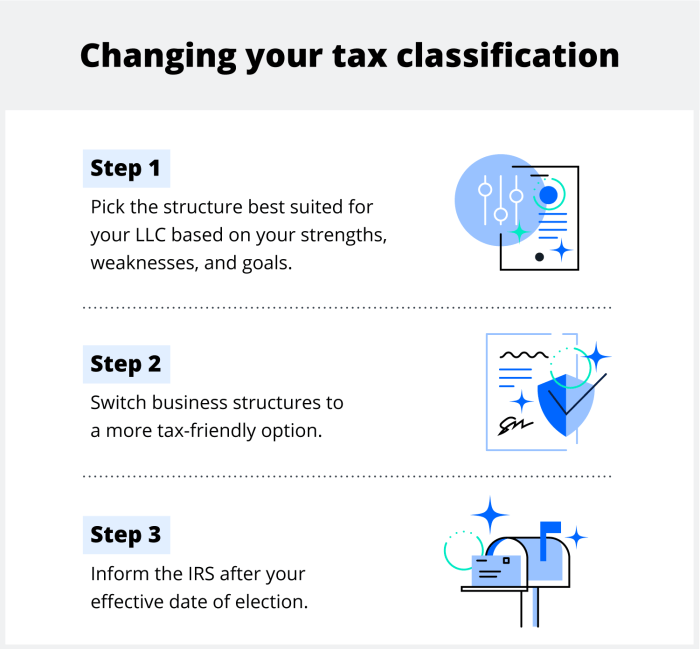

Budgeting Strategy for Insurance Expenses

- Start by assessing the risks specific to your LLC to determine the necessary coverage.

- Research different insurance providers to compare quotes and coverage options that align with your budget and needs.

- Set aside a dedicated budget for insurance expenses to ensure you can cover the costs without impacting other crucial areas of your LLC.

Negotiating Premiums and Optimal Coverage

- Consider bundling your insurance policies with the same provider to potentially receive discounts on premiums.

- Review your coverage needs regularly to ensure you’re not overpaying for insurance that your LLC may not require.

- Work with an insurance agent to negotiate premiums and customize your coverage to best suit your LLC’s specific needs and budget.

Last Recap

In conclusion, understanding the necessity of business insurance for your LLC is paramount in safeguarding your assets and ensuring financial stability. By delving into the various aspects discussed, you are equipped with the knowledge to make informed decisions for the protection and growth of your business.

FAQ

Do I need business insurance for my LLC if it’s a small business?

Yes, regardless of the size of your LLC, having business insurance is essential to protect your assets from potential risks and liabilities.

What types of insurance are crucial for an LLC?

Key types of insurance for an LLC include general liability, professional liability, and property insurance to cover various aspects of your business.

Can not having business insurance affect my LLC’s reputation?

Absolutely, lacking proper insurance can lead to financial instability and damage your LLC’s reputation in the long run.