Exploring the realm of Best Business Insurance Providers for LLCs in 2025, this introduction sets the stage for a deep dive into the world of insurance, highlighting key aspects that businesses should consider.

As we navigate through the landscape of insurance providers, coverage options, and emerging trends, readers will gain valuable insights into securing the best insurance for their LLCs in the coming year.

Introduction to Business Insurance for LLCs

Business insurance for Limited Liability Companies (LLCs) serves as a crucial safety net to protect the assets and operations of the company. It provides financial coverage in case of unexpected events or liabilities that could potentially harm the business.

Importance of Having Business Insurance for LLCs in 2025

As we move into 2025, the business landscape continues to evolve, presenting new challenges and risks for companies. Having adequate business insurance is essential for LLCs to safeguard their interests and mitigate potential losses. With the uncertainties in the market, having comprehensive insurance coverage can provide peace of mind and ensure the long-term sustainability of the business.

Types of Coverage Typically Needed by LLCs

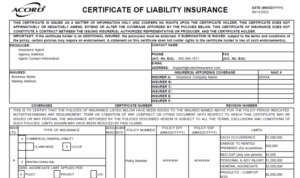

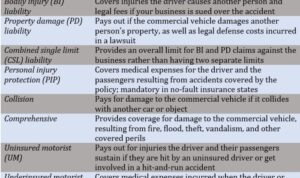

- General Liability Insurance: This coverage protects the LLC from claims of bodily injury, property damage, and advertising injury.

- Property Insurance: It covers the physical assets of the LLC, including buildings, equipment, and inventory, against damage or loss due to fire, theft, or other covered perils.

- Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, this type of coverage protects the LLC from claims of negligence or inadequate work performance.

- Workers’ Compensation Insurance: Required by law in most states, this insurance provides coverage for medical expenses and lost wages for employees who are injured on the job.

- Business Interruption Insurance: This coverage helps replace lost income and covers ongoing expenses if the LLC’s operations are disrupted due to a covered event, such as a natural disaster.

Factors to Consider When Choosing an Insurance Provider

When selecting an insurance provider for your LLC, there are several key factors that you should take into consideration to ensure you are getting the right coverage for your business needs.

Coverage Options

- Compare and contrast the types of coverage options offered by different insurance providers, such as general liability, property, workers’ compensation, and professional liability insurance.

- Consider the specific needs of your LLC and choose a provider that offers customizable policies to meet those needs.

- Look for additional coverage options that may be beneficial for your business, such as cyber liability insurance or business interruption insurance.

Financial Stability

- Research the financial stability of insurance providers by checking their ratings from independent rating agencies like A.M. Best, Moody’s, or Standard & Poor’s.

- Choose an insurance provider that has a strong financial standing to ensure they will be able to fulfill claims in case of a loss.

Reputation

- Consider the reputation of insurance providers by reading reviews and testimonials from other businesses who have used their services.

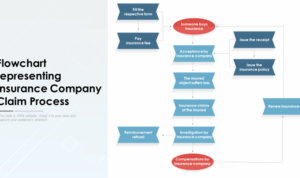

- Check if the insurance provider has a history of timely claims processing and good customer service to ensure a smooth experience in case you need to file a claim.

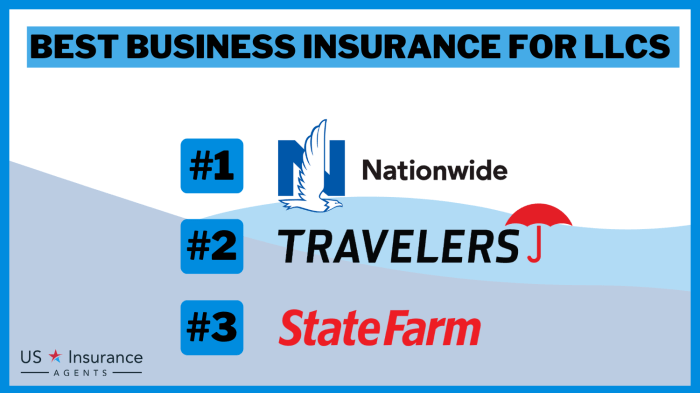

Top Business Insurance Providers for LLCs in 2025

When it comes to selecting the best insurance provider for your LLC, there are several top-notch options available in the market. These providers offer tailored coverage options to meet the specific needs of limited liability companies. Let’s take a closer look at some of the leading business insurance providers for LLCs in 2025.

1. State Farm

State Farm is a well-known insurance provider that offers a range of coverage options for LLCs. They provide general liability insurance, property insurance, and even business interruption insurance to protect your company in case of unexpected events. State Farm is known for its competitive premiums and excellent customer service, making them a popular choice among LLC owners.

2. The Hartford

The Hartford specializes in providing insurance solutions for small businesses, including LLCs. They offer comprehensive coverage options such as general liability, professional liability, and commercial property insurance. The Hartford also stands out for its flexible policies and customizable coverage plans, allowing LLC owners to tailor their insurance to their specific needs.

3. Nationwide

Nationwide is another top insurance provider that caters to LLCs of all sizes. They offer a wide range of coverage options, including general liability, cyber liability, and workers’ compensation insurance. Nationwide is known for its competitive premiums and robust coverage benefits, making them a reliable choice for LLC owners looking for comprehensive insurance protection.

4. Hiscox

Hiscox specializes in providing professional liability insurance for small businesses, including LLCs. They offer errors and omissions insurance, as well as cyber liability insurance to protect against data breaches and other cyber risks. Hiscox is recognized for its quick claims processing and online policy management tools, making it convenient for LLC owners to manage their insurance coverage.

5. Chubb

Chubb is a leading insurance provider that offers a wide range of coverage options for LLCs. They provide general liability insurance, commercial property insurance, and even specialty coverage for unique risks. Chubb is known for its financial strength and extensive network of agents, ensuring that LLC owners receive top-notch support and service.These top business insurance providers for LLCs in 2025 offer a variety of coverage options, competitive premiums, and unique benefits tailored to the needs of limited liability companies.

When choosing an insurance provider for your LLC, consider factors such as coverage options, premiums, customer service, and any additional services or features that set them apart from others in the market.

Emerging Trends in Business Insurance for LLCs

In 2025, the landscape of business insurance for LLCs is witnessing significant changes due to emerging trends that are reshaping the industry. From technological advancements to evolving regulations, these trends are impacting the way insurance providers tailor their offerings to meet the needs of LLCs.

Technology Integration in Business Insurance

With the rapid advancement of technology, insurance providers are increasingly leveraging tools such as artificial intelligence and data analytics to enhance their services for LLCs. These technologies enable more personalized risk assessments, faster claims processing, and improved overall efficiency in managing insurance policies.

Shift towards Cyber Insurance Coverage

As cyber threats continue to pose a growing risk to businesses, there is a noticeable trend towards offering specialized cyber insurance coverage for LLCs. With the increasing frequency of cyberattacks, insurance providers are adapting their policies to include protection against data breaches, ransomware attacks, and other cyber risks that LLCs may face.

Regulatory Changes Impacting Insurance Offerings

Changing regulations and market conditions play a crucial role in shaping the insurance offerings available to LLCs. With evolving compliance requirements and industry standards, insurance providers are adjusting their policies to ensure that LLCs have access to comprehensive coverage that aligns with the latest regulatory guidelines.

Focus on Sustainability and ESG Factors

In response to the growing emphasis on sustainability and environmental, social, and governance (ESG) factors, insurance providers are incorporating these considerations into their offerings for LLCs. By promoting sustainable business practices and addressing ESG risks, insurers are helping LLCs mitigate potential liabilities and enhance their overall resilience in a rapidly changing business environment.

Final Wrap-Up

In conclusion, the discussion on Best Business Insurance Providers for LLCs in 2025 sheds light on the importance of robust insurance coverage, the nuances of selecting the right provider, and the evolving landscape of insurance trends. Stay informed, stay protected, and thrive in the world of business with the right insurance for your LLC.

User Queries

What are the key factors to consider when choosing an insurance provider for an LLC?

LLCs should consider factors like coverage options, financial stability, reputation, and tailored services when selecting an insurance provider.

Which insurance providers are specifically tailored for LLCs in 2025?

Some of the best insurance providers for LLCs in 2025 include XYZ Insurance and ABC Insurance, offering comprehensive coverage, competitive premiums, and unique services designed for LLCs.

How do changing regulations impact insurance offerings for LLCs?

Changing regulations can influence the types of coverage available to LLCs, affecting premium rates and policy terms. Staying informed about regulatory changes is crucial for businesses to adapt their insurance strategies.