Embark on your journey to understanding Business Insurance for LLC with this comprehensive Step-by-Step Buying Guide. Explore the intricacies of insurance options for your LLC and make informed decisions to protect your business effectively.

Delve deeper into the realm of business insurance tailored for LLCs, as we unravel the complexities and nuances of selecting the right coverage for your unique business needs.

Understand the Basics of Business Insurance for LLC

Business insurance is a crucial investment for LLCs as it provides protection against various risks and liabilities that could potentially harm the business. Having the right insurance coverage in place can help safeguard the assets of the LLC and ensure its continued operation in case of unforeseen events.

Types of Business Insurance Available for LLCs

- General Liability Insurance: This type of insurance provides coverage for claims of bodily injury, property damage, and advertising injury.

- Property Insurance: Property insurance protects the physical assets of the LLC, such as buildings, equipment, and inventory, against damage or loss.

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage protects the LLC against claims of negligence or failure to perform professional services.

- Workers’ Compensation Insurance: Required by law in most states, workers’ compensation insurance provides benefits to employees who are injured or become ill while on the job.

Legal Requirements for Business Insurance as an LLC

While business insurance requirements vary depending on the location and nature of the LLC’s operations, there are some common legal requirements that LLCs may need to fulfill:

- Workers’ Compensation Insurance: As mentioned earlier, workers’ compensation insurance is mandatory in most states if the LLC has employees.

- Auto Insurance: If the LLC owns vehicles for business purposes, it is required to have commercial auto insurance to cover any accidents or damages involving these vehicles.

- Professional Liability Insurance: Certain professions or industries may have specific legal requirements for professional liability insurance to operate legally.

Assess Your Insurance Needs

When it comes to evaluating the specific insurance needs of an LLC, it’s essential to consider the unique risks and vulnerabilities that your business may face. By identifying these risks, you can determine the types of insurance coverage that are most crucial for protecting your LLC.

Common Risks Covered by Business Insurance

- General Liability Insurance: Protects against claims of bodily injury, property damage, and advertising injury.

- Property Insurance: Covers damage or loss of business property due to fire, theft, vandalism, or other covered perils.

- Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, it provides protection against claims of negligence or inadequate work.

- Workers’ Compensation Insurance: Mandatory in most states, it covers medical expenses and lost wages for employees injured on the job.

Calculating Coverage Amounts

- Assess Your Assets: Calculate the total value of your business assets, including property, equipment, and inventory.

- Evaluate Potential Liabilities: Consider potential risks that could result in lawsuits or financial losses for your LLC.

- Consult with an Insurance Professional: Work with an insurance agent or broker to determine the appropriate coverage limits based on your specific needs and budget.

- Review Coverage Regularly: As your business grows or changes, make sure to reassess your insurance needs and adjust coverage amounts accordingly.

Research Insurance Providers

When looking for the right insurance provider for your LLC, it is important to conduct thorough research to ensure you are getting the best coverage for your business. Here are some steps to help you identify reputable insurance providers for LLCs.

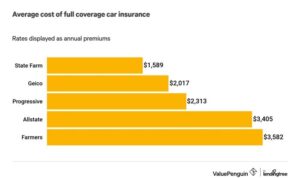

Compare Different Insurance Companies

- Consider coverage options: Look for insurance companies that offer policies tailored to the specific needs of LLCs. This may include general liability insurance, property insurance, professional liability insurance, and more.

- Evaluate pricing: Compare quotes from different insurance providers to ensure you are getting competitive rates for the coverage you need.

- Read customer reviews: Take the time to research customer feedback and reviews to get an idea of the level of satisfaction other LLC owners have had with a particular insurance provider.

Select a Specialized Insurance Provider

- Importance of specialization: Choose an insurance provider that specializes in coverage for LLCs. These providers will have a better understanding of the unique risks and needs of your business structure.

- Expertise in LLC insurance: Look for insurance companies with experience in working with LLCs to ensure they can provide the right coverage and support for your business.

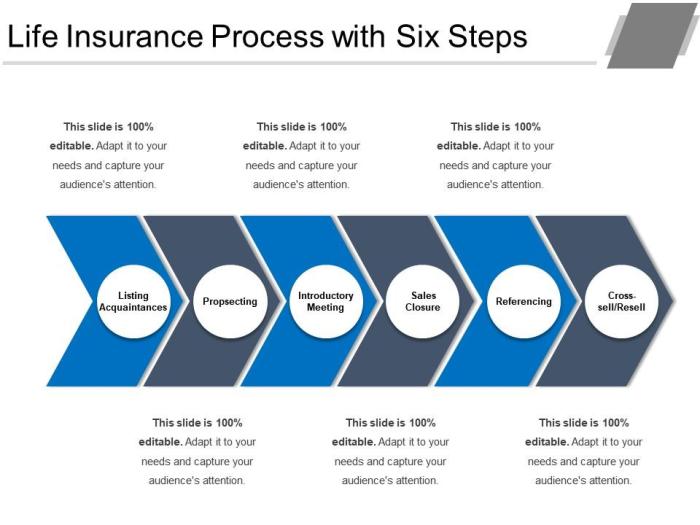

Obtain Insurance Quotes

When looking to obtain insurance quotes for your LLC, there are several steps you can follow to ensure you get the best coverage at a competitive price.

Research Insurance Providers

- Start by researching insurance providers that specialize in coverage for LLCs.

- Look for companies with a good reputation and positive reviews from other business owners.

- Compare the coverage options and pricing offered by different providers to find the best fit for your business.

Provide Detailed Information

- When requesting insurance quotes, make sure to provide detailed information about your LLC, including the nature of your business, the size of your company, and any specific risks you may face.

- Be prepared to answer questions about your business operations, revenue, and any previous insurance claims you may have filed.

- The more information you provide, the more accurate and tailored your insurance quotes will be.

Factors Influencing Insurance Quotes

- Factors that can influence insurance quotes for LLCs include the type of coverage you need, the size and nature of your business, your location, and your claims history.

- Other factors may include the industry you operate in, the number of employees you have, and the value of your business assets.

- Insurance providers will assess these factors to determine the level of risk associated with insuring your LLC, which will impact the cost of your insurance quotes.

Negotiate for the Best Coverage

- When negotiating insurance quotes for your LLC, be sure to ask about any discounts or customized coverage options that may be available to you.

- Compare quotes from different providers and don’t be afraid to negotiate for better rates or additional coverage benefits.

- Consider bundling multiple types of insurance policies with the same provider to potentially receive a discount on your premiums.

Purchase Business Insurance for Your LLC

When it comes to purchasing insurance for your LLC, there are a few key steps to keep in mind. It’s crucial to understand the process, including the necessary paperwork and payment requirements, to ensure you have the right coverage for your business.

Review Insurance Policy Details

Before finalizing the purchase of your business insurance policy, it is essential to carefully review all the details included. Make sure you understand the coverage limits, exclusions, deductibles, and any additional riders or endorsements that may be relevant to your specific needs.

If you have any questions or concerns about the policy terms, do not hesitate to reach out to the insurance provider for clarification.

Addressing Questions or Concerns

If you encounter any questions or concerns during the buying process, it is important to address them promptly. Reach out to the insurance provider or your insurance agent to seek clarification or additional information. It’s better to have a clear understanding of your policy before making the purchase rather than discovering gaps in coverage later on.

Summary

In conclusion, navigating the landscape of Business Insurance for LLC can be a daunting task, but armed with the knowledge from this guide, you can confidently secure the protection your business deserves. Make informed choices and safeguard your LLC’s future with the right insurance coverage.

Common Queries

What are the legal requirements for business insurance as an LLC?

Most states require LLCs to have certain types of insurance, such as workers’ compensation and general liability insurance, depending on the nature of the business.

How can I calculate the appropriate coverage amounts for my LLC?

To determine the right coverage, consider factors like the size of your business, industry risks, and assets that need protection. Consulting with an insurance agent can help you assess your needs accurately.

What should I do if I have questions or concerns during the insurance buying process?

If you encounter any uncertainties or need clarifications, don’t hesitate to reach out to your insurance provider or agent. They are there to assist you in making informed decisions.