Exploring the distinct insurance needs of LLCs versus Sole Proprietorships sheds light on crucial factors that shape their coverage requirements. Let’s delve into the intricate world of business insurance to uncover how these structures navigate the realm of risk management.

As we dissect the nuances of insurance essentials for LLCs and Sole Proprietorships, a clearer picture emerges of the tailored protection each entity must secure to safeguard its operations effectively.

Differences in Business Insurance Needs between LLCs and Sole Proprietorships

When it comes to business insurance, the needs of an LLC (Limited Liability Company) differ significantly from those of a sole proprietorship. The structure and size of the business, the number of owners, and the level of risk involved all play a role in determining the type and amount of insurance required for each business entity.

Key Factors Influencing Insurance Needs

- Ownership Structure: An LLC typically has multiple owners, known as members, which can increase the complexity of insurance needs compared to a sole proprietorship where there is only one owner.

- Liability Protection: One of the primary reasons for forming an LLC is to protect personal assets from business liabilities. This means that an LLC may require more comprehensive liability insurance coverage than a sole proprietorship.

- Business Size: The size of the business, in terms of revenue, employees, and assets, can impact the insurance needs. Larger businesses may need more extensive coverage to protect against potential risks.

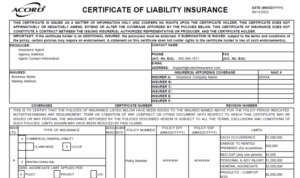

Specific Insurance Policies for LLCs

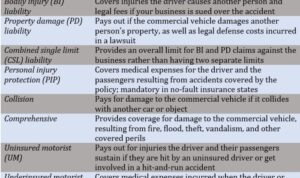

- General Liability Insurance: This policy protects an LLC from claims of bodily injury, property damage, and advertising injury.

- Errors and Omissions Insurance: Also known as professional liability insurance, this coverage is essential for LLCs that provide services or professional advice.

- Commercial Property Insurance: This policy protects the physical assets of the business, such as buildings, equipment, and inventory.

Insurance Policies for Sole Proprietorships

- Professional Liability Insurance: While not as common for sole proprietorships, this coverage may still be necessary for certain professions that involve providing services or advice.

- Business Owner’s Policy (BOP): A BOP combines general liability insurance and property insurance into one package, which can be beneficial for small sole proprietorships.

Liability Coverage for LLCs vs. Sole Proprietorships

When it comes to liability coverage, there are significant differences between LLCs and sole proprietorships. Let’s explore the various options available and how liability risks vary based on the business structure.

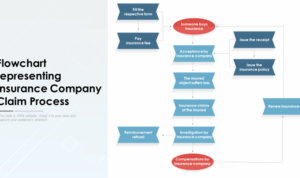

Liability Coverage Options

In terms of liability coverage, LLCs have the advantage of limited liability protection. This means that the personal assets of LLC owners are generally protected from business debts and lawsuits. On the other hand, sole proprietorships do not offer this level of protection, as the business and personal assets of the owner are considered one and the same.

Varying Liability Risks

For LLCs, the risk of personal liability is reduced due to the separation of personal and business assets. However, if an LLC fails to maintain proper legal and financial separation between the business and its owners, there is a risk of “piercing the corporate veil,” which could expose personal assets to business liabilities.

Sole proprietorships face a higher risk of personal liability since there is no legal distinction between the business and its owner.

Scenarios Requiring Critical Liability Coverage for LLCs

- If an LLC is sued for a large sum of money and does not have enough assets to cover the judgment, liability coverage becomes crucial to protect the personal assets of the owners.

- In cases where the business operates in a high-risk industry or deals with potentially dangerous products/services, having liability coverage is essential for an LLC to mitigate the risks involved.

- When entering into contracts or agreements that could result in legal disputes, having liability coverage can help shield the personal assets of LLC owners from potential litigation costs.

Cost Differences in Insurance for LLCs and Sole Proprietorships

When it comes to insurance costs, there are notable differences between LLCs and sole proprietorships. These variations can have a significant impact on the overall financial health of the business. Understanding the factors that contribute to these differences and implementing strategies to reduce insurance costs is crucial for both types of business entities.

Factors Contributing to Differences in Insurance Costs

- Business Structure: The legal structure of the business, whether it’s an LLC or a sole proprietorship, can influence insurance costs. LLCs typically have higher upfront costs due to the need for more comprehensive coverage to protect the business and its members.

- Number of Employees: The size of the workforce can also impact insurance costs. LLCs with more employees may require additional coverage, leading to higher premiums compared to sole proprietorships with fewer or no employees.

- Industry Risk: The nature of the business and the industry it operates in can affect insurance costs. Businesses operating in high-risk industries may face higher premiums to mitigate potential liabilities.

Strategies for Reducing Insurance Costs

- Shop Around: It’s essential for both LLCs and sole proprietorships to compare quotes from multiple insurance providers to find the most cost-effective coverage that meets their needs.

- Risk Management: Implementing risk management practices can help reduce the likelihood of claims and lower insurance premiums. This can include workplace safety measures, employee training, and regular maintenance of equipment.

- Bundling Policies: Bundling different types of insurance policies, such as general liability and property insurance, with the same provider can often lead to discounts and lower overall costs.

Compliance Requirements for Business Insurance

When it comes to compliance requirements for business insurance, both LLCs and sole proprietorships have specific regulations they must adhere to. These requirements are in place to protect the business, its assets, and any potential liabilities that may arise. Understanding the differences in compliance based on the business structure is crucial to ensure proper coverage and legal protection.

Insurance Regulations for LLCs and Sole Proprietorships

- LLCs typically have more stringent insurance requirements compared to sole proprietorships. Depending on the state and industry, LLCs may be required to have certain types of insurance such as general liability, professional liability, workers’ compensation, and commercial property insurance.

- Sole proprietorships, on the other hand, may have fewer mandatory insurance requirements. However, it is still essential for sole proprietors to consider liability coverage, property insurance, and other relevant policies to protect their business assets.

Ensuring Compliance with Insurance Regulations

- Research and understand the specific insurance requirements for your business structure and industry.

- Consult with an insurance agent or broker who has experience working with LLCs or sole proprietorships to ensure you have adequate coverage.

- Maintain accurate records of your insurance policies and renewals to demonstrate compliance with regulations.

- Regularly review and update your insurance coverage to reflect any changes in your business operations or risk factors.

Outcome Summary

In conclusion, grasping the nuances of business insurance for LLCs and Sole Proprietorships unveils the strategic approach necessary to mitigate risks and fortify financial stability. By understanding the distinct needs and liabilities of each structure, businesses can navigate the insurance landscape with confidence and resilience.

FAQ Insights

What specific insurance policies are essential for an LLC but may not be as crucial for a sole proprietorship?

LLCs typically require specialized policies like Errors and Omissions Insurance or Directors and Officers Insurance to protect against lawsuits, while sole proprietorships may not need these due to their structure.

How do liability risks vary between LLCs and sole proprietorships?

LLCs offer limited liability protection, shielding personal assets from business debts and lawsuits. In contrast, sole proprietorships expose personal assets to business liabilities, increasing the risk for the owner.

What factors contribute to variations in insurance premiums for LLCs and sole proprietorships?

Factors like business size, industry risks, past claims history, and coverage limits play a significant role in determining insurance premiums for both LLCs and sole proprietorships.

How do compliance requirements for insurance coverage differ between LLCs and sole proprietorships?

LLCs often have more stringent compliance requirements due to their separate legal entity status, whereas sole proprietorships may have fewer regulatory obligations when it comes to insurance coverage.