Embark on a journey through the intricacies of Commercial Auto Policy Renewal for Fleet Owners, where we delve into the importance of policy renewal, understanding coverage options, factors influencing renewal decisions, the renewal process steps, and common mistakes to avoid.

Get ready to explore the essential aspects of managing your fleet’s insurance policies.

Importance of Commercial Auto Policy Renewal

Renewing commercial auto policies is a critical aspect for fleet owners to ensure the continued protection of their vehicles, drivers, and business operations.

Key Benefits of Renewing Commercial Auto Policies

- Continued Coverage: Renewing policies ensures that fleet owners have ongoing protection against unforeseen accidents, damages, or liabilities.

- Compliance: Updated policies help fleet owners stay compliant with state regulations and avoid penalties or legal issues.

- Cost-Effectiveness: Regular policy renewals may offer opportunities to review and optimize coverage options, potentially saving money in the long run.

Impact on Fleet Owner’s Business Operations

Policy renewals can directly impact a fleet owner’s business operations in various ways:

- Uninterrupted Service: Renewed policies help ensure that vehicles can continue operating without disruptions due to lack of insurance coverage.

- Driver Safety: Updated policies may include provisions for driver training, safety measures, and compliance standards, enhancing overall safety within the fleet.

- Financial Stability: Adequate insurance coverage through policy renewals can protect fleet owners from unexpected financial burdens in case of accidents or damages.

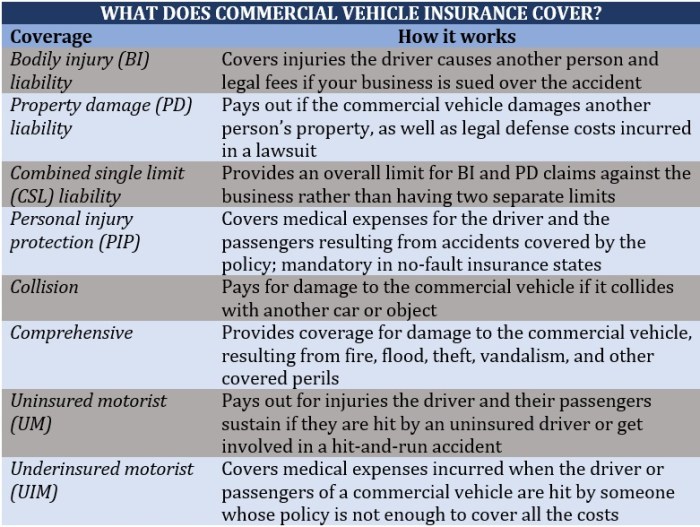

Understanding Commercial Auto Policy Coverage

When it comes to commercial auto insurance, fleet owners need to have a clear understanding of the coverage options available to protect their vehicles, drivers, and business operations.

Typical Coverage Options in Commercial Auto Policies

- Liability Coverage: This is the most basic coverage that protects fleet owners in case their vehicles cause damage to someone else’s property or injure another person.

- Collision Coverage: This coverage helps pay for repairs or replacement of vehicles damaged in collisions, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects against non-collision incidents such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage helps cover costs if your fleet is involved in an accident with a driver who lacks insurance or sufficient coverage.

Comparison of Coverage Levels

- Basic Coverage: Fleet owners may opt for minimum coverage to meet legal requirements, but this may leave them vulnerable to significant financial losses in case of accidents.

- Enhanced Coverage: Investing in comprehensive coverage can provide fleet owners with greater peace of mind and protection against a wider range of risks.

Scenarios Requiring Specific Coverage Options

- Example 1: A fleet vehicle is involved in a collision with a third party, resulting in property damage. Liability coverage would help cover the costs of repairs or replacement.

- Example 2: One of the fleet vehicles is stolen overnight. Comprehensive coverage would help cover the costs of replacing the stolen vehicle.

- Example 3: A driver from another vehicle causes an accident with one of the fleet vehicles and lacks insurance. Uninsured/Underinsured Motorist Coverage would help cover the costs in this scenario.

Factors Influencing Policy Renewal Decisions

When fleet owners are considering renewing their commercial auto policies, there are several key factors they should take into account to make informed decisions. These factors can have a significant impact on the terms and premiums of their policy, as well as the overall coverage provided.

It’s crucial for fleet owners to carefully evaluate these factors to ensure they are getting the best possible policy for their specific needs.

Regulatory Changes

Regulatory changes can have a direct impact on commercial auto insurance policies. Fleet owners need to stay informed about any new regulations or laws that may affect their industry or the way insurance coverage is structured. For example, changes in liability limits or requirements for specific types of coverage can influence policy renewal decisions.

It’s important for fleet owners to work closely with their insurance provider to understand how regulatory changes may impact their policy and what adjustments need to be made.

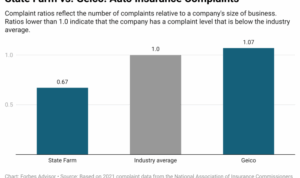

Past Claims History

One of the most significant factors that can influence policy renewal terms and premiums is the fleet’s past claims history. Insurance providers will typically review the claims history of the fleet to assess the level of risk involved in providing coverage.

If a fleet has a history of frequent or costly claims, this can result in higher premiums or more restrictive terms upon renewal. On the other hand, a clean claims history can lead to more favorable renewal terms. Fleet owners should strive to maintain a strong safety record and implement risk management strategies to minimize the impact of past claims on their policy renewal.

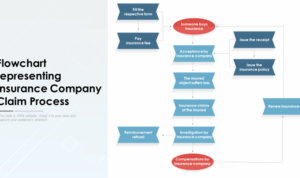

Steps in the Policy Renewal Process

Renewing your commercial auto policy as a fleet owner is a crucial task to ensure your vehicles and business are adequately protected. The policy renewal process involves several steps that need to be followed diligently to avoid any gaps in coverage or unnecessary costs.

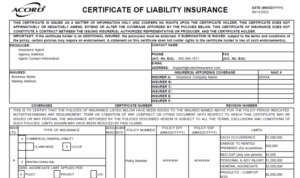

Checklist of Documents and Information Required

- Gather all current policy documents, including coverage details and limits.

- Provide updated vehicle information, such as VIN numbers, make, and model.

- Submit driver information, including driving records and certifications.

- Review any claims or incidents that occurred during the previous policy term.

- Prepare financial information related to your fleet operation for assessment.

Tips on Negotiating Renewal Terms with Insurance Providers

- Start the renewal process early to have ample time for negotiations and comparisons.

- Research and understand your coverage needs to have a clear idea of what you require.

- Compare quotes from multiple insurance providers to leverage better terms and rates.

- Highlight any improvements or changes in your fleet operation that could positively impact your renewal terms.

- Discuss bundling options or loyalty discounts with your current insurance provider for potential savings.

- Seek clarification on any terms or conditions that are unclear to ensure you fully understand the coverage provided.

Common Mistakes to Avoid During Policy Renewal

When renewing their commercial auto policies, fleet owners often make common mistakes that can have significant implications on their coverage, premiums, and overall business operations. By being aware of these mistakes and implementing strategies to prevent or rectify them, fleet owners can ensure a successful policy renewal process.

Not Reviewing Coverage Needs

One common mistake is not reviewing the coverage needs of the fleet before renewing the policy. This can result in inadequate coverage or paying for coverage that is not needed, leading to potential gaps in protection or unnecessary expenses. Fleet owners should regularly assess their fleet size, types of vehicles, and specific risks to ensure they have the right coverage in place.

Neglecting to Update Information

Another mistake is neglecting to update important information, such as changes in the fleet size, drivers, or operations. Failing to provide accurate and up-to-date information to the insurance provider can lead to issues with claims processing and potential coverage disputes.

Fleet owners should communicate any changes promptly to ensure their policy reflects the current state of their operations.

Ignoring Safety and Training Programs

Ignoring safety and training programs is another common mistake that can impact policy renewal. Insurance providers may offer discounts or incentives for implementing safety measures and providing driver training. By overlooking these programs, fleet owners may miss out on opportunities to lower premiums and improve overall safety standards within their fleet.

Overlooking Claims History

Overlooking the claims history of the fleet can also be a critical mistake during policy renewal. A high frequency of claims or a record of at-fault accidents can result in increased premiums or difficulty in finding coverage. Fleet owners should actively manage claims, promote safe driving practices, and work towards reducing the number of incidents to maintain favorable terms during policy renewal.

Failing to Shop Around

Failing to shop around and explore different insurance options is another mistake that fleet owners should avoid. By comparing quotes from multiple providers, fleet owners can potentially find better coverage terms, more competitive premiums, and additional benefits. It is essential to review options annually to ensure the current policy remains the best fit for the fleet’s needs.

Not Seeking Professional Advice

Lastly, not seeking professional advice or guidance during the policy renewal process can be a costly mistake. Insurance agents or brokers can offer valuable insights, recommend suitable coverage options, and assist in negotiating terms with providers. Fleet owners should take advantage of expert advice to ensure they make informed decisions and secure optimal policy terms.

Ending Remarks

In conclusion, navigating the Commercial Auto Policy Renewal landscape for fleet owners requires attention to detail, strategic decision-making, and a proactive approach. By understanding the nuances of policy renewal, fleet owners can optimize their coverage, minimize risks, and ensure the smooth operation of their businesses.

User Queries

What are the key benefits of regularly renewing commercial auto policies?

Regular renewal ensures continuous coverage, potential cost savings, and compliance with legal requirements.

How does past claims history influence policy renewal terms?

A history of frequent claims may lead to higher premiums or stricter renewal terms.

What documents are typically required during the policy renewal process?

Documents like vehicle registration, driver information, and previous policy details are commonly needed.