When it comes to Geico Commercial Auto Insurance vs State Farm Comparison, the decision-making process can be a challenging one. Let’s dive into the details to help you choose the best option for your business needs.

In this comprehensive comparison, we will explore the key differences between Geico and State Farm in terms of coverage, pricing, customer service, and online tools.

Overview of Geico Commercial Auto Insurance and State Farm

Geico Commercial Auto Insurance offers coverage specifically tailored for businesses that rely on vehicles for their operations. They provide protection for a wide range of vehicles, from cars to trucks, ensuring that businesses can operate smoothly without worrying about potential risks on the road.

Key Features of State Farm’s Commercial Auto Insurance Policies

- State Farm’s commercial auto insurance policies offer customizable coverage options to meet the unique needs of businesses.

- They provide liability coverage to protect against damages and injuries caused to others in an accident.

- State Farm also offers coverage for physical damage to the insured vehicle, as well as medical payments and uninsured/underinsured motorist coverage.

History and Reputation of Geico and State Farm

- Geico, founded in 1936, is known for its innovative marketing strategies and competitive rates in the insurance industry.

- State Farm, established in 1922, has built a strong reputation for excellent customer service and a wide range of insurance products.

- Both companies have a long-standing presence in the market and are well-respected for their financial stability and commitment to customer satisfaction.

Coverage Options

When it comes to commercial auto insurance, having the right coverage is essential to protect your business assets and employees. Geico and State Farm both offer a range of coverage options tailored to meet the specific needs of commercial vehicle owners.

Let’s take a closer look at the different types of coverage available with each provider.

Geico Commercial Auto Insurance Coverage Options

Geico provides a comprehensive range of coverage options for commercial auto insurance, including:

- Bodily Injury Liability

- Property Damage Liability

- Collision Coverage

- Comprehensive Coverage

- Medical Payments

- Uninsured/Underinsured Motorist Coverage

State Farm Commercial Auto Insurance Coverage Options

State Farm also offers a variety of coverage options for commercial auto insurance, such as:

- Bodily Injury Liability

- Property Damage Liability

- Collision Coverage

- Comprehensive Coverage

- Medical Payments

- Uninsured/Underinsured Motorist Coverage

Unique or Specialized Coverage Options

Both Geico and State Farm provide additional specialized coverage options to cater to the unique needs of commercial vehicle owners. These may include:

- Hired Auto Coverage

- Non-Owned Auto Coverage

- Rental Reimbursement Coverage

- Towing and Roadside Assistance

- Cargo Insurance

- Equipment Breakdown Coverage

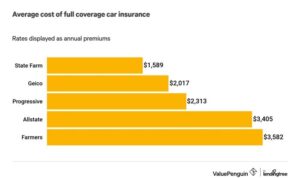

Pricing and Discounts

When it comes to pricing and discounts for commercial auto insurance, both Geico and State Farm offer competitive options for businesses. Let’s take a closer look at how each company determines pricing and what discount opportunities are available.

Geico Commercial Auto Insurance Pricing

Geico determines the pricing for their commercial auto insurance policies based on various factors such as the type of vehicles insured, the driving records of employees, the coverage limits selected, and the location of the business. Additionally, factors like the number of vehicles insured and the purpose of use (e.g., transporting goods, employees, or passengers) can also impact the overall cost of the policy.

Geico Commercial Auto Insurance Discounts

Geico offers a range of discount options for businesses with commercial auto insurance policies. Some common discounts include multi-vehicle discounts for insuring multiple vehicles under the same policy, safety feature discounts for vehicles equipped with anti-theft devices or safety features, and good driver discounts for businesses with employees who have clean driving records.

Additionally, businesses may be eligible for discounts based on their industry or affiliation with certain organizations.

State Farm Commercial Auto Insurance Pricing and Discounts

State Farm also considers similar factors when determining the pricing for their commercial auto insurance policies, such as the type of vehicles insured, driving records, coverage limits, and business location. However, the specific pricing structure may vary between Geico and State Farm based on individual underwriting criteria.In terms of discounts, State Farm offers various opportunities for businesses with commercial auto insurance.

These discounts may include multi-policy discounts for combining commercial auto insurance with other types of coverage, good student discounts for businesses with employees who are students with good grades, and accident-free discounts for businesses with a claims-free history. State Farm may also offer discounts for businesses with certain safety features installed on their vehicles or for completing defensive driving courses.Overall, both Geico and State Farm provide pricing options and discount opportunities to help businesses protect their commercial vehicles while saving money on insurance premiums.

Customer Service and Claims Process

When it comes to commercial auto insurance, customer service and claims handling are crucial aspects to consider. Let’s delve into the experiences with Geico and State Farm in these areas.

Geico Customer Service and Claims Process

- Geico is known for its efficient and responsive customer service for commercial auto insurance clients.

- They offer multiple channels for customers to reach out, including phone, online chat, and a mobile app.

- Geico’s claims process is streamlined and hassle-free, with dedicated representatives guiding clients through each step.

- Customers appreciate the ease of filing claims and the quick resolution provided by Geico.

State Farm Reputation and Claims Handling

- State Farm has a strong reputation for excellent customer service in the insurance industry.

- They have a large network of agents who are available to assist clients with any questions or concerns.

- State Farm’s claims handling process is thorough and transparent, ensuring that clients are well-informed throughout the claim settlement.

- Customers value the personalized attention and support they receive from State Farm agents during the claims process.

Online Tools and Resources

When it comes to managing commercial auto insurance policies, having access to online tools and resources can make a significant difference in convenience and efficiency. Let’s take a look at what Geico and State Farm offer in terms of digital resources for their policyholders.

Geico’s Online Tools and Resources

Geico provides policyholders with a user-friendly online platform where they can easily manage their commercial auto insurance policies. Some of the key online tools and resources offered by Geico include:

- Online policy management: Policyholders can view and manage their policies, make payments, and update their information online.

- Claims tracking: Geico’s online portal allows policyholders to track the status of their claims and access important claim-related documents.

- Resource center: Geico offers a resource center with helpful articles, FAQs, and tips for commercial auto insurance policyholders.

State Farm’s Digital Resources

State Farm also provides policyholders with a comprehensive online platform for managing commercial auto insurance policies. Here are some of the digital resources offered by State Farm:

- Online account management: Policyholders can access their policies, make payments, and request changes to their coverage online through State Farm’s website.

- Mobile app: State Farm’s mobile app allows policyholders to manage their policies, file claims, and get roadside assistance on the go.

- Educational tools: State Farm offers educational resources and tools to help policyholders understand their coverage options and make informed decisions.

Both Geico and State Farm offer user-friendly online platforms that are easy to navigate and provide a range of tools and resources to help policyholders manage their commercial auto insurance policies effectively. Whether you prefer the simplicity of Geico’s online portal or the convenience of State Farm’s mobile app, both insurance providers have digital resources to enhance the overall customer experience.

Final Conclusion

In conclusion, both Geico and State Farm offer competitive commercial auto insurance options, each with its own strengths. It’s essential to carefully consider your specific requirements and preferences before making a decision.

Questions Often Asked

How does Geico determine pricing for commercial auto insurance?

Geico calculates pricing based on factors such as the type of coverage, the number of vehicles insured, driving history, and the location of the business.

What unique coverage options does State Farm offer for commercial auto insurance?

State Farm provides specialized coverage options such as rental reimbursement, gap coverage, and rideshare insurance for business vehicles.