How Much Does Business Insurance for an LLC Cost? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Exploring the factors affecting costs, types of insurance available, average pricing structures, and tips for obtaining quotes will shed light on this crucial aspect of running an LLC.

Factors Affecting Business Insurance Costs

When it comes to determining the cost of business insurance for an LLC, several factors come into play. Understanding these factors is crucial for business owners to make informed decisions about their insurance needs.

Business Size

The size of a business is a significant factor in determining insurance costs. Larger businesses typically have higher insurance premiums due to the increased risk exposure and the potential for larger claims.

Industry Risk

The industry in which a business operates greatly influences insurance costs. Industries with higher risks of liability or property damage, such as construction or healthcare, will generally have higher premiums compared to low-risk industries like consulting.

Coverage Types

The types of coverage a business chooses also impact insurance costs. Additional coverage beyond basic liability insurance, such as property insurance, workers’ compensation, or cyber liability insurance, will result in higher premiums.

Location

The location of a business plays a role in insurance costs. Businesses located in areas prone to natural disasters or with higher crime rates may face increased premiums to cover these risks.

Number of Employees and Revenue

The number of employees and the revenue of a business can affect insurance premiums. More employees mean a higher likelihood of claims, while higher revenue indicates a larger business with potentially more assets to protect.

Types of Business Insurance for an LLC

When it comes to protecting your LLC, having the right insurance coverage is crucial. There are several types of business insurance options available for an LLC, each serving a specific purpose. Let’s explore the differences between general liability, professional liability, property, and workers’ compensation insurance, and examples of situations where each type is essential for an LLC.

General Liability Insurance

General liability insurance is a fundamental coverage that protects your business from claims of bodily injury, property damage, and personal injury. It can help cover legal fees, settlements, and medical expenses in case of accidents or incidents that occur on your business premises or as a result of your operations.

For example, if a customer slips and falls in your store, general liability insurance can cover their medical bills and any legal costs associated with the incident.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is essential for service-based businesses. It protects your LLC from claims of negligence, errors, or omissions in the services you provide. This type of insurance can cover legal fees, settlements, and damages if a client alleges that your services led to financial loss or harm.

For instance, if a client sues your consulting firm for providing incorrect advice that resulted in financial losses, professional liability insurance can help cover the costs.

Property Insurance

Property insurance is crucial for protecting your business property, including buildings, equipment, inventory, and other assets. It can provide coverage for damage or loss caused by fire, theft, vandalism, or natural disasters. Having property insurance ensures that your LLC can recover and rebuild in case of unexpected events.

For example, if a fire damages your office space and equipment, property insurance can help cover the cost of repairs or replacements.

Workers’ Compensation Insurance

Workers’ compensation insurance is mandatory in most states and provides coverage for employees who suffer work-related injuries or illnesses. It helps cover medical expenses, lost wages, and rehabilitation costs for injured employees. Having workers’ compensation insurance not only protects your employees but also shields your LLC from potential lawsuits related to workplace injuries.

In a scenario where an employee injures their back while lifting heavy boxes in your warehouse, workers’ compensation insurance can cover their medical bills and lost wages.

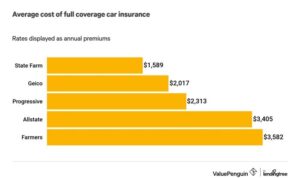

Average Costs and Pricing Structures

When it comes to business insurance for an LLC, the costs can vary depending on various factors. Let’s delve into the average costs and pricing structures to get a better understanding of what to expect.Insurance companies typically determine the cost of business insurance for an LLC based on industry benchmarks, the size of the business, the type of coverage needed, and the location of the business.

Here is a breakdown of the common pricing structures you can expect:

Average Costs by Type of Insurance Coverage

- General Liability Insurance: On average, general liability insurance for an LLC can cost anywhere from $500 to $3,000 per year.

- Professional Liability Insurance: The cost of professional liability insurance, also known as errors and omissions insurance, can range from $500 to $5,000 annually.

- Property Insurance: Property insurance costs for an LLC can vary widely depending on the value of the property, but on average, it can range from $500 to $3,000 per year.

- Workers’ Compensation Insurance: The cost of workers’ compensation insurance is typically based on the number of employees and the type of work they do, with average annual premiums ranging from $1,000 to $10,000.

These are just rough estimates and actual costs may vary based on individual circumstances and the insurance provider. It’s essential to shop around and compare quotes to find the best coverage at a competitive price.

Obtaining and Comparing Insurance Quotes

When it comes to obtaining and comparing insurance quotes for your LLC, there are a few key tips to keep in mind to ensure you get the best coverage at a reasonable cost.

Importance of Getting Multiple Quotes

It is crucial to get quotes from multiple insurance providers to compare rates and coverage options. By obtaining quotes from different companies, you can ensure that you are getting the best deal for your business.

Aspects to Consider When Comparing Quotes

- Coverage Limits: Make sure the quotes you receive offer adequate coverage for your business needs. Consider the types of risks your LLC may face and choose a policy that provides comprehensive protection.

- Deductibles: Compare the deductibles offered by different insurers. A higher deductible may result in lower premiums, but you should also consider if you can afford the out-of-pocket expenses in case of a claim.

- Policy Exclusions: Pay attention to any exclusions listed in the policies. Ensure that the coverage provided aligns with your specific business activities and requirements.

- Additional Benefits: Some insurance policies may come with additional benefits or coverage options. Compare these extras to see which insurer offers the most value for your money.

- Financial Stability: Research the financial stability of the insurance providers you are considering. You want to make sure the company will be able to fulfill its obligations in case you need to file a claim.

Closing Summary

In conclusion, understanding the costs associated with business insurance for an LLC is essential for safeguarding your enterprise. With this knowledge, you can make informed decisions to protect your business effectively.

Query Resolution

What factors influence the cost of business insurance for an LLC?

Factors include business size, industry risk, coverage types, location, number of employees, and revenue.

What are the types of insurance coverage options available for an LLC?

Types include general liability, professional liability, property, and workers’ compensation insurance.

What are the average costs of business insurance for an LLC based on industry benchmarks?

Average costs vary by industry, with pricing structures like monthly premiums, deductibles, and coverage limits playing a role.

How can I obtain and compare insurance quotes for an LLC?

Obtain multiple quotes from different providers, considering aspects like coverage adequacy and cost balance.