Exploring the world of auto policy customization is a journey filled with possibilities. From understanding the intricate details of policy quotes to comparing quotes from different providers, this guide will equip you with the knowledge needed to tailor your auto policy to meet your specific needs.

As we delve into the nuances of customizing auto policy quotes, you’ll discover practical tips and strategies to navigate the process with ease and confidence.

Understanding Auto Policy Quotes

When it comes to auto policy quotes, it is essential to understand the various components that make up the quote, the factors that influence the pricing, and the different coverage options available. Let’s delve into these aspects to help you make informed decisions when customizing your auto policy.

Components of an Auto Policy Quote

An auto policy quote typically includes several key components such as:

- Liability coverage: This covers bodily injury and property damage that you may cause to others in an accident.

- Collision coverage: This pays for damages to your own vehicle in the event of a collision.

- Comprehensive coverage: This covers damages to your vehicle from incidents other than collisions, such as theft, vandalism, or natural disasters.

- Personal injury protection: This covers medical expenses for you and your passengers in the event of an accident, regardless of fault.

Factors Influencing Auto Policy Quotes

Several factors can influence the cost of your auto policy quote, including:

- Driving record: A clean driving record typically results in lower premiums, while accidents and traffic violations can lead to higher rates.

- Vehicle make and model: The type of car you drive, its age, and safety features can impact your insurance rates.

- Location: Where you live and where you park your car can affect your insurance premiums.

- Coverage limits: The amount of coverage you choose and your deductibles can also impact the cost of your auto policy.

Types of Coverage Options in Auto Policies

Auto policies offer various coverage options to suit different needs, including:

- Uninsured/underinsured motorist coverage: This protects you if you are in an accident with a driver who does not have insurance or enough coverage.

- Rental car reimbursement: This coverage pays for a rental car if your vehicle is in the shop for repairs after an accident.

- Roadside assistance: This provides help if your car breaks down on the road, such as towing, fuel delivery, and jump-start services.

Personalizing Auto Policy Quotes

Personalizing auto policy quotes is crucial to ensure that you have the right coverage for your specific needs. By customizing your policy, you can tailor it to fit your individual circumstances, driving habits, and budget.

Adjusting Coverage Limits

When customizing your auto policy, one important aspect to consider is adjusting coverage limits. This involves determining the amount of coverage you need for different types of protection, such as liability, collision, and comprehensive coverage. To tailor coverage limits to your needs, consider factors like your assets, driving record, and the value of your vehicle.

For example, if you have significant assets to protect, you may opt for higher liability limits to safeguard your financial security in case of a lawsuit.

Adding or Removing Optional Coverages

Another way to personalize your auto policy is by adding or removing optional coverages based on your specific requirements. Optional coverages like roadside assistance, rental car reimbursement, and gap insurance can provide additional protection but may not be necessary for everyone.

Evaluate your needs and budget to decide which optional coverages are worth adding to your policy. On the other hand, you can save money by removing coverages that you do not need or already have through other sources.

Comparing Quotes from Different Providers

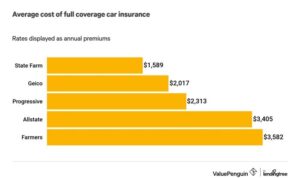

When comparing auto policy quotes from different insurance providers, it is essential to consider various key elements to ensure you are making an informed decision that meets your needs. While price is a significant factor, it is equally important to look beyond the cost to assess the overall value of the policy.

Evaluating the reputation and customer service of insurance companies offering quotes can provide valuable insight into their reliability and commitment to customer satisfaction.

Key Elements to Consider

- Coverage Options: Compare the types of coverage offered by each provider to ensure they align with your needs and preferences.

- Deductibles and Limits: Evaluate the deductibles and coverage limits to determine the out-of-pocket expenses you may incur in the event of a claim.

- Discounts and Rewards: Look for discounts or rewards programs that can help you save money on your premium while still receiving quality coverage.

Looking Beyond Price

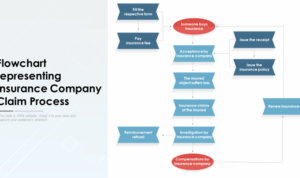

- Claims Process: Research the ease and efficiency of the claims process for each provider to understand how they handle customer claims.

- Financial Stability: Review the financial strength ratings of insurance companies to ensure they can fulfill their obligations in case of a large number of claims.

- Coverage Exclusions: Pay attention to any exclusions or limitations in the policy that may affect your coverage in specific situations.

Evaluating Reputation and Customer Service

- Customer Reviews: Read reviews and testimonials from current and past customers to gauge their satisfaction levels and experiences with the insurance provider.

- Claims Satisfaction: Look into the provider’s claims satisfaction ratings to understand how well they respond to and resolve customer claims.

- Customer Support: Consider the accessibility and responsiveness of customer support services offered by the insurance company.

Utilizing Technology for Customization

Technology plays a crucial role in customizing auto policy quotes, offering a range of tools and platforms to simplify the process and tailor quotes to individual needs. By leveraging these technological solutions, consumers can adjust coverage options, compare quotes from different providers, and make informed decisions regarding their auto insurance.

Benefits of Using Online Platforms

- Online platforms provide convenience and accessibility, allowing users to customize their auto policy quotes from the comfort of their own homes.

- These platforms often offer interactive tools and calculators to help users understand how different coverage options impact their premiums.

- Users can easily input their information once and receive multiple quotes from various insurance providers, saving time and effort in the comparison process.

- Online platforms may also provide educational resources and support to help users make informed decisions about their coverage needs.

Examples of Software or Apps

- Insurance Comparison Websites:Websites like Compare.com, The Zebra, and Insurance.com allow users to compare quotes from multiple insurance companies in one place.

- Insurance Apps:Mobile applications like Gabi, Cover, and EverQuote offer a streamlined way to customize auto policy quotes on the go.

- Insurance Company Websites:Many insurance companies have online portals that enable customers to adjust coverage options, view quotes, and make changes to their policies digitally.

Conclusive Thoughts

In conclusion, customizing auto policy quotes is not just about finding the best price, but about finding the perfect balance of coverage that suits your individual requirements. By utilizing technology and understanding the key elements of policy quotes, you can create a tailored auto policy that provides you with the peace of mind you deserve.

FAQ Overview

How important is it to customize auto policy quotes?

Customizing auto policy quotes is crucial as it ensures that you have the right coverage for your specific needs, providing financial protection in case of unforeseen events.

What factors should I consider when personalizing my auto policy quotes?

When customizing your auto policy quotes, factors like your driving habits, the value of your vehicle, and your budget should all be taken into account to tailor the coverage to your requirements.

How can technology assist in customizing auto policy quotes?

Technology tools can simplify the process of customizing auto policy quotes by allowing you to adjust coverage options, compare quotes easily, and even purchase your policy online.