How to Get Free Business Insurance Quotes for Your LLC sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. When it comes to protecting your LLC, understanding the ins and outs of business insurance quotes is essential.

As you delve into the intricacies of finding the right coverage for your business, this guide will walk you through the process of researching, comparing quotes, and customizing insurance policies tailored to your LLC’s unique needs.

Researching Business Insurance Quotes

When it comes to getting business insurance for your LLC, researching multiple insurance providers is crucial. This allows you to compare quotes, coverage options, and pricing to find the best fit for your company.

Importance of Researching Multiple Insurance Providers

- Helps you find the most competitive rates

- Allows you to explore different coverage options

- Gives you a better understanding of what each provider offers

Key Factors to Consider When Comparing Quotes

- Price: Compare premiums and deductibles to find the best value

- Coverage: Ensure the policy covers all the essential needs of your LLC

- Reputation: Look into the insurance provider’s track record and customer reviews

Determining the Coverage Needs of Your LLC

- Assess the specific risks your business faces

- Consider industry requirements and regulations

- Factor in the size and scope of your operations

Finding Insurance Providers

When looking for insurance providers for your LLC, it is essential to consider reputable companies that offer free quotes. This can help you compare different options and find the best coverage for your business needs.

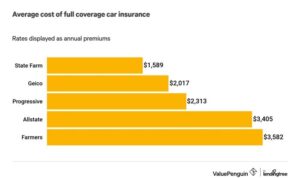

List of Reputable Insurance Companies

- State Farm

- Allstate

- Progressive

- Geico

- Nationwide

Benefits of Online Platforms

Using online platforms to obtain insurance quotes can offer several advantages. You can easily compare multiple quotes from different providers, saving time and effort. Online platforms also often provide detailed information about coverage options, helping you make an informed decision.

Local Insurance Agents vs. Online Quotes

While local insurance agents can provide personalized guidance and support, obtaining quotes online can be more convenient and efficient. Online quotes allow you to compare multiple options quickly and easily, without the need for in-person meetings. This can be particularly beneficial if you have a busy schedule or prefer to research and compare options independently.

Requesting and Reviewing Quotes

When it comes to getting free business insurance quotes for your LLC, the process of requesting and reviewing them is crucial to finding the right coverage for your company. Here’s how you can navigate this process effectively.

Requesting Free Business Insurance Quotes

- Start by identifying reputable insurance providers that offer coverage for LLCs.

- Visit the websites of these providers or contact them directly to request quotes.

- Provide detailed information about your LLC, including the nature of your business, number of employees, revenue, and any specific insurance needs.

- Some providers may offer online forms where you can input your information to receive quotes instantly.

- Be prepared to answer follow-up questions or provide additional documentation to get accurate quotes.

Reviewing and Comparing Quotes

- Once you receive multiple insurance quotes, carefully review each one to understand the coverage and costs involved.

- Compare key aspects such as coverage limits, deductibles, premiums, and any additional benefits offered.

- Consider the reputation and financial stability of the insurance providers to ensure they can support your claims in the future.

- Look for any exclusions or limitations in the policies that may impact your coverage in specific scenarios.

- Take note of any discounts or customizations that can be added to tailor the policy to your LLC’s needs.

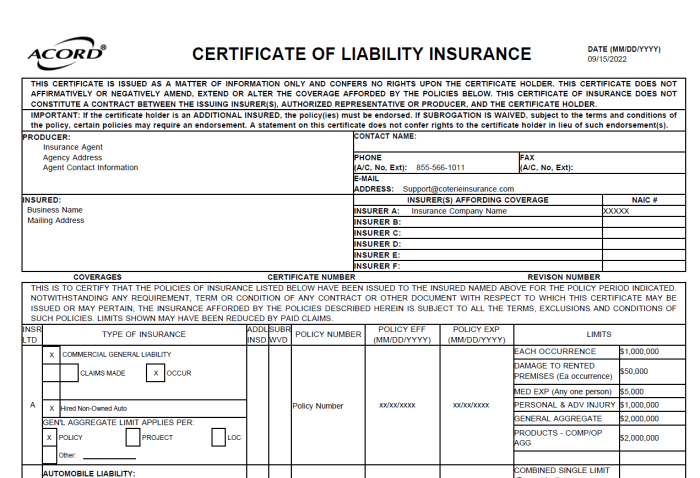

Understanding Policy Details and Exclusions

- Pay close attention to the fine print of each insurance policy to understand the terms and conditions that apply.

- Clarify any unclear language or terms with the insurance provider to avoid misunderstandings in the future.

- Ensure you know what is covered and what is excluded under the policy to avoid surprises during a claim.

- Consult with a legal or insurance professional if you need assistance interpreting complex policy details.

Customizing Insurance Policies for Your LLC

When it comes to protecting your LLC with the right insurance coverage, customization is key. Tailoring your insurance policies to meet the specific needs of your business can help ensure that you are adequately protected against potential risks. Here are some tips on how to customize your insurance policies for your LLC:

Optional Coverages to Consider

- Business Interruption Insurance: This coverage can help replace lost income and cover expenses if your business is unable to operate due to a covered event, such as a natural disaster.

- Cyber Liability Insurance: In today’s digital age, protecting your LLC from cyber-attacks and data breaches is crucial. Cyber liability insurance can help cover costs associated with a cyber-attack, such as data recovery and legal fees.

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage can protect your LLC from claims of negligence or inadequate work. It is particularly important for service-based businesses.

Ensuring Adequate Coverage

- Assess Your Risks: Identify the specific risks that your LLC faces and make sure your insurance policies provide adequate coverage for those risks.

- Review Regularly: As your business grows and evolves, your insurance needs may change. Regularly reviewing your policies and adjusting coverage as needed can help ensure that you are always adequately protected.

- Work with an Insurance Professional: Consulting with an insurance agent or broker who specializes in business insurance can help you navigate the complexities of insurance policies and ensure that you have the right coverage for your LLC.

Final Conclusion

In conclusion, navigating the world of business insurance quotes for your LLC can seem daunting, but armed with the knowledge and insights provided in this guide, you can make informed decisions to safeguard your business. Remember, securing the right insurance coverage is a crucial step towards ensuring the longevity and success of your LLC.

FAQ Resource

Why is researching multiple insurance providers important?

Researching multiple insurance providers allows you to compare quotes, coverage options, and pricing to ensure you find the best fit for your LLC’s needs. It helps in making an informed decision.

What are some key factors to consider when comparing quotes?

Key factors include coverage limits, deductibles, premiums, types of coverage offered, and any additional benefits or exclusions that may impact your decision.

How can I accurately review and compare the quotes received?

To accurately review quotes, ensure you are comparing similar coverage options, understand policy details and exclusions, and consider the overall value each quote provides for your LLC.

Why is customizing insurance policies important for your LLC?

Customizing insurance policies ensures that your coverage aligns with your business’s specific needs, providing tailored protection against potential risks that your LLC may face.