Shop Car Insurance Quotes Before Renewal to Save Money sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

When it comes to renewing car insurance, taking the time to shop around for quotes can make a significant impact on your savings. By exploring different options and providers, you can potentially find better rates and coverage that suit your needs.

This guide will delve into the importance of this practice and provide valuable tips to help you maximize your savings.

Importance of Shopping Car Insurance Quotes Before Renewal

When it comes to renewing your car insurance, taking the time to shop around for quotes can make a significant difference in the cost and coverage you receive. Here are some reasons why it’s crucial to compare car insurance quotes before renewal:

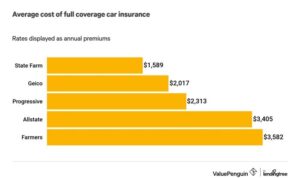

Save Money

One of the most obvious benefits of shopping for car insurance quotes before renewal is the potential to save money. By comparing quotes from different providers, you can find a policy that offers the coverage you need at a more competitive price.

This can result in significant savings over time.

Get Better Coverage

By exploring different options from various insurance companies, you can also find a policy that offers better coverage than your current one. This can include additional benefits, higher limits, or more comprehensive protection for your vehicle.

Identify Discounts and Special Offers

Each insurance provider may offer different discounts and special offers that can help lower your premium. By shopping around, you can take advantage of these opportunities and potentially reduce the overall cost of your car insurance.

Factors to Consider When Shopping for Car Insurance Quotes

When comparing car insurance quotes, there are several key factors that you should consider to ensure you get the best coverage at the most competitive price.

Coverage Options Impact on Cost

- When shopping for car insurance quotes, it’s crucial to understand how different coverage options can impact the cost of your premium. Comprehensive coverage, which includes protection for damages not caused by a collision, will typically cost more than basic liability coverage.

- Consider the specific needs of your vehicle and personal situation when selecting coverage options. While it may be tempting to opt for the cheapest policy, it’s important to ensure you have adequate coverage in case of an accident or other unforeseen events.

- Review the coverage limits for each policy you are considering to determine if they meet your needs. Higher coverage limits will result in a higher premium, but they can provide greater protection in the event of a serious accident.

Importance of Deductibles and Limits

- Another important factor to consider when shopping for car insurance quotes is the deductible amount. The deductible is the amount you will have to pay out of pocket before your insurance coverage kicks in.

- Choosing a higher deductible can lower your premium, but it also means you will have to pay more in the event of a claim. Conversely, a lower deductible will result in a higher premium, but you will have less out-of-pocket expenses if you need to file a claim.

- Review the coverage limits for each policy you are considering to determine if they meet your needs. Higher coverage limits will result in a higher premium, but they can provide greater protection in the event of a serious accident.

Tips for Saving Money on Car Insurance Renewal

When it comes time to renew your car insurance, there are several strategies you can use to save money and get the best deal possible. Whether it’s negotiating with your current provider or exploring discounts, being proactive can help lower your insurance costs.

Negotiate for Better Rates

Don’t be afraid to negotiate with your insurance provider for better rates. If you have a good driving record or can show that you are a low-risk driver, you may be able to secure a lower premium.

Bundle Policies for Discounts

Consider bundling your car insurance with other policies, such as home or life insurance, to qualify for a multi-policy discount. This can result in significant savings on your overall insurance costs.

Qualify for Discounts

Take advantage of any discounts you may be eligible for, such as safe driver discounts, good student discounts, or discounts for having certain safety features in your vehicle. These discounts can add up and lead to substantial savings on your car insurance.

Understanding the Renewal Process for Car Insurance

When it comes to renewing your car insurance, understanding the process can help you make informed decisions and potentially save money. It’s essential to be aware of how the renewal process works, any changes that may occur, and the importance of reviewing policy details before committing to another term.

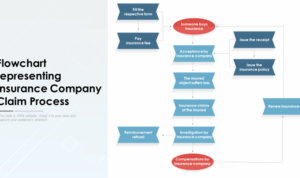

Typical Process of Renewing Car Insurance

Renewing car insurance typically involves receiving a renewal notice from your current insurance provider. This notice Artikels the details of your existing policy, including coverage, premiums, and renewal terms. You may have the option to renew automatically or make changes to your coverage before the renewal date.

Potential Changes During the Renewal Process

- Changes in Premiums: Your insurance premiums may increase or decrease based on various factors, such as your driving record, changes in coverage, or external factors affecting insurance rates.

- Policy Updates: Your insurance provider may introduce new policy features, adjust coverage limits, or modify terms and conditions during the renewal process.

- Discounts and Incentives: You may be eligible for new discounts or incentives during the renewal period, which could help you save money on your car insurance.

Importance of Reviewing Policy Details Before Renewal

Before renewing your car insurance, it’s crucial to review your policy details carefully. By understanding your coverage, premiums, and any changes in the policy, you can ensure that you have the right protection for your needs and budget. Additionally, reviewing policy details allows you to identify any errors or discrepancies that may affect your insurance coverage.

Closure

In conclusion, shopping for car insurance quotes before renewal is a smart financial move that can lead to significant savings. By carefully considering different factors, negotiating for better rates, and understanding the renewal process, you can make informed decisions that benefit your wallet.

Don’t miss out on potential savings – start comparing quotes today!

FAQs

Why is shopping for car insurance quotes before renewal important?

Shopping for car insurance quotes before renewal is crucial as it allows you to explore different options and potentially find better rates that can lead to savings on your insurance premiums.

How can shopping for car insurance quotes help in saving money?

By comparing quotes from different providers, you can identify cost-effective options and potentially secure discounts or better coverage that align with your budget.

What factors should be considered when shopping for car insurance quotes?

Key factors to consider include coverage options, deductibles, limits, and any potential discounts or bundling opportunities that can impact the overall cost of insurance.

How can I save money on car insurance renewal?

To save money on car insurance renewal, consider negotiating with insurance providers, exploring discounts, bundling policies, and reviewing your coverage needs to ensure you’re not overpaying.

What is the renewal process for car insurance like?

The renewal process typically involves reviewing policy details, making any necessary updates, and paying the renewal premium to continue your coverage. Changes may occur, so it’s essential to stay informed.