Diving into the world of small business insurance for LLC owners unveils a plethora of essential insights and considerations. From understanding the importance of insurance to exploring various coverage options, this guide is a must-read for those looking to protect their business ventures.

As we delve deeper into the nuances of insurance coverage for LLC owners, a wealth of valuable information will be uncovered, shedding light on the complexities of safeguarding your business interests.

Importance of Small Business Insurance for LLC Owners

Small business insurance is a critical component for LLC owners as it provides financial protection and risk management for their business operations. Without adequate insurance coverage, LLC owners are exposed to various risks that could potentially lead to financial ruin or legal liabilities.

Risks Mitigated by Small Business Insurance

- Property Damage: Insurance can help cover costs associated with damage to business property due to fire, theft, or other unforeseen events.

- Liability Claims: Insurance can protect LLC owners from legal claims related to bodily injury, property damage, or other liabilities arising from business activities.

- Business Interruption: Insurance can provide coverage for lost income and expenses in the event of a temporary shutdown due to covered perils.

- Employee Injuries: Workers’ compensation insurance can help cover medical expenses and lost wages for employees injured on the job.

Legal Requirements and Implications

- State Requirements: Many states require businesses, including LLCs, to carry certain types of insurance such as workers’ compensation or general liability insurance.

- Contractual Obligations: Some contracts with clients or landlords may also require LLC owners to have specific insurance coverage in place.

- Lawsuits and Penalties: Operating without the necessary insurance coverage can result in lawsuits, fines, or even the dissolution of the LLC in some cases.

Protection of Personal Assets

Insurance coverage can help shield the personal assets of LLC owners from being at risk in case of a lawsuit or financial loss related to the business. By separating personal and business assets through insurance, LLC owners can safeguard their personal finances and properties from potential claims or debts associated with the business.

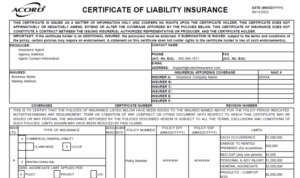

Types of Insurance Coverage Needed for LLC Owners

When running a small business as an LLC owner, it is crucial to have the right insurance coverage to protect your assets and mitigate risks. Here are the key types of insurance policies needed for LLC owners:

General Liability Insurance

General liability insurance provides coverage for third-party claims of bodily injury, property damage, and advertising injury. It protects your business from lawsuits and helps cover legal expenses. This type of insurance is essential for all LLC owners to safeguard against unexpected accidents or incidents.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is crucial for LLC owners who provide professional services or advice. It covers claims of negligence, errors, or omissions that may arise from your professional services. This insurance can help protect your business from lawsuits related to mistakes or inadequate work.

Property Insurance

Property insurance is vital for LLC owners who own or lease commercial space, equipment, or inventory. It provides coverage for damage or loss of physical assets due to events like fire, theft, or natural disasters. Having property insurance ensures that your business can recover and continue operations after a covered event.

Workers’ Compensation Insurance

LLC owners with employees must have workers’ compensation insurance to provide benefits for employees who are injured or become ill on the job. This insurance helps cover medical expenses, lost wages, and disability benefits for employees, protecting both the employees and the business from financial strain.

Business Interruption Insurance

Business interruption insurance is essential for LLC owners to protect against revenue loss due to unexpected events that disrupt business operations. This insurance provides coverage for lost income, ongoing expenses, and temporary relocation costs during the period of interruption. It helps ensure that your business can survive and recover from unforeseen disruptions.

Factors to Consider When Choosing Insurance for an LLC

When selecting insurance coverage for your LLC, there are several crucial factors to take into consideration to ensure adequate protection for your business.

Size and Nature of the Business Impact

- Consider the size of your business in terms of revenue, number of employees, and assets. Larger businesses may require higher coverage limits.

- The nature of your business activities will also impact the type of insurance needed. For example, a construction company may need more liability coverage than a consulting firm.

- Evaluate the potential risks specific to your industry to determine appropriate coverage. This could include risks related to product liability, professional services, or property damage.

Location Influence on Insurance Requirements

- The location of your business can influence insurance requirements due to varying state regulations and local risks. For example, businesses in areas prone to natural disasters may need additional coverage for property damage.

- Consider local laws and requirements for insurance coverage, such as workers’ compensation or general liability insurance, which may vary based on where your business is located.

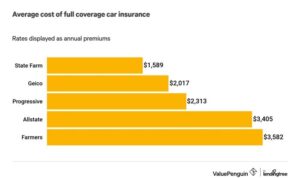

Tips for Saving Money on Small Business Insurance

Managing costs is crucial for small business owners, especially when it comes to insurance expenses. Here are some strategies to help you save money on your small business insurance while still ensuring you have adequate coverage:

Benefits of Bundling Insurance Policies

One effective way to reduce your insurance costs is by bundling multiple policies together. By combining your general liability, property, and other insurances with the same provider, you can often qualify for significant discounts. This not only saves you money but also streamlines the management of your policies.

Lowering Premiums with Safety Measures

Implementing safety measures in your business can lead to lower insurance premiums. By reducing the risk of accidents or incidents, insurance companies view your business as less risky to insure. Installing security systems, training employees on safety protocols, and maintaining a clean and hazard-free work environment are some ways to demonstrate your commitment to safety and potentially lower your premiums.

Regularly Reviewing and Updating Policies

It’s essential to regularly review your insurance policies to ensure you are not paying for coverage you no longer need or missing out on new discounts. As your business grows or changes, your insurance needs may evolve as well. By staying informed about your policy options and comparing quotes from different providers, you can make sure you are getting the best coverage at the most competitive rates.

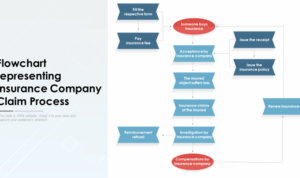

Understanding the Claims Process for Small Business Insurance

When it comes to small business insurance, understanding the claims process is crucial for LLC owners. Knowing the steps involved in filing an insurance claim, how to document and report incidents, the role of insurance adjusters, and tips for expediting the process can help maximize payouts and protect the business.

Filing an Insurance Claim for a Small Business

- Notify your insurer immediately after an incident occurs that may lead to a claim.

- Document the details of the incident, including photos, videos, and witness statements.

- Complete the necessary claim forms provided by your insurance company.

- Cooperate with any investigations or requests for information from your insurer.

Documenting and Reporting Incidents to Your Insurer

- Keep detailed records of the incident, including dates, times, and descriptions of what happened.

- Provide all relevant documentation to your insurer, such as police reports or medical records.

- Be honest and accurate in your reporting to avoid any delays or potential denial of your claim.

Role of Insurance Adjusters in Evaluating Claims

- Insurance adjusters assess the damage or loss and determine the coverage under your policy.

- They may conduct investigations, interview witnesses, and review documentation to validate your claim.

- Cooperating with insurance adjusters and providing necessary information can speed up the evaluation process.

Tips for Expediting the Claims Process and Maximizing Payouts

- Respond promptly to all requests and communications from your insurer.

- Keep detailed records and documentation to support your claim.

- Work with reputable contractors or service providers for repairs or replacements.

- Review your policy carefully to understand your coverage and rights as a policyholder.

Last Point

In conclusion, navigating the realm of small business insurance for LLC owners requires a strategic approach and a keen understanding of the risks involved. By implementing the tips and insights shared in this guide, you can ensure the protection and longevity of your business endeavors.

FAQ Resource

What are the key factors to consider when choosing insurance for an LLC?

Factors to consider include the business size, nature of operations, potential risks, and location. Evaluating these aspects can help determine the most appropriate coverage for your LLC.

Is business interruption insurance essential for LLC owners?

Business interruption insurance can be crucial for LLCs, especially when unexpected events disrupt operations. It helps cover lost income and ongoing expenses during such challenging times.

How can LLC owners save money on small business insurance?

LLC owners can save money by bundling policies, implementing safety measures to lower premiums, and regularly reviewing and updating their insurance policies to ensure optimal coverage at competitive rates.