Delving into What Type of Business Insurance Does an LLC Need?, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

As we explore the various types of business insurance essential for an LLC, it’s crucial to understand the significance of adequate coverage in protecting your business assets.

Types of Business Insurance

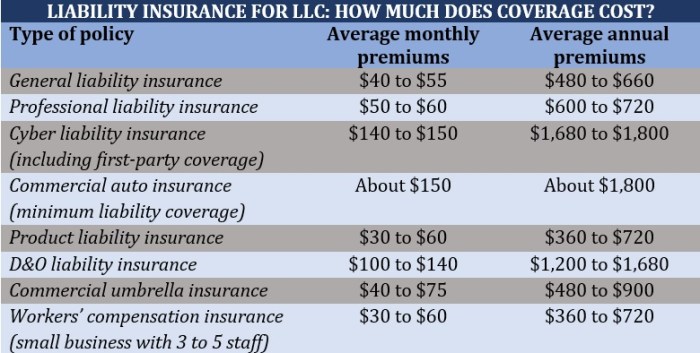

When it comes to protecting your LLC, having the right business insurance in place is crucial. Here are some common types of business insurance that an LLC may need:

General Liability Insurance

General liability insurance is essential for protecting your LLC from third-party claims of bodily injury, property damage, and personal injury. This type of insurance can cover legal fees, medical expenses, and settlements.

Professional Liability Insurance

Also known as errors and omissions insurance, professional liability insurance provides coverage for claims of negligence, errors, or omissions in the services your LLC provides. This is especially important for businesses that offer professional services.

Property Insurance

Property insurance helps protect your LLC’s physical assets, such as buildings, equipment, inventory, and furniture, from damage or loss due to fire, theft, vandalism, or other covered perils.

Workers’ Compensation Insurance

If your LLC has employees, workers’ compensation insurance is typically required by law. This insurance provides coverage for medical expenses and lost wages for employees who are injured on the job.

Business Interruption Insurance

Business interruption insurance can help your LLC recover lost income and operating expenses if your business is forced to close temporarily due to a covered event, such as a natural disaster or fire.Having multiple types of insurance coverage can help protect your LLC from various risks and liabilities, providing you with peace of mind and financial security in case the unexpected happens.

General Liability Insurance

General liability insurance is a crucial type of coverage for LLCs as it protects the business from financial loss resulting from claims of bodily injury, property damage, advertising mistakes, and personal injury. This insurance provides coverage for legal costs and settlements if the business is sued for covered claims.

What General Liability Insurance Covers for an LLC

- Bodily Injury: If a customer slips and falls in your store and gets injured, general liability insurance can cover medical expenses and legal fees if the customer decides to sue.

- Property Damage: In case your business causes damage to someone else’s property, this insurance can help cover the costs of repair or replacement.

- Personal Injury: This includes claims of defamation, slander, or copyright infringement against your business.

- Advertising Mistakes: If your advertising leads to a lawsuit, general liability insurance can help cover legal costs and damages.

Why General Liability Insurance is Essential for an LLC

- Protection: General liability insurance offers protection against a wide range of risks that a business may face in its day-to-day operations.

- Legal Requirements: Some states require businesses to have this insurance to operate legally.

- Credibility: Having general liability insurance can also enhance the credibility of your business when dealing with clients or partners.

Scenarios Where General Liability Insurance Would Come into Play

- If a customer slips and falls in your retail store and sustains injuries, leading to a lawsuit against your business.

- If your product accidentally causes property damage to a client’s home or business premises, resulting in a claim for compensation.

- In the event of a competitor suing your business for false advertising claims, alleging financial losses as a result.

Property Insurance

Property insurance provides coverage for the physical assets of an LLC, including buildings, equipment, inventory, and furniture. In the event of damage or loss due to covered perils, property insurance helps the business recover by providing financial compensation for repairs or replacements.

Coverage Provided by Property Insurance

- Protection against fire, theft, vandalism, and natural disasters.

- Reimbursement for damaged or stolen property.

- Coverage for business interruption due to property damage.

Examples of Situations Where Property Insurance Would be Beneficial

- A fire breaks out in the office, destroying computers, furniture, and important documents.

- A break-in results in stolen equipment and inventory.

- A severe storm causes roof damage to the building, affecting operations.

Importance of Insuring Business Property Against Various Risks

- Protects the business from financial losses due to property damage.

- Ensures continuity of operations by covering repair or replacement costs.

- Provides peace of mind knowing that the business assets are safeguarded.

Workers’ Compensation Insurance

Workers’ compensation insurance is a crucial type of coverage for LLCs that have employees. It provides financial protection for both the employees and the business in case of work-related injuries or illnesses.

Significance of Workers’ Compensation Insurance

Workers’ compensation insurance covers medical expenses, lost wages, and rehabilitation costs for employees who are injured or become ill while performing their job duties. This coverage helps ensure that employees are taken care of and can return to work as soon as possible.

What Workers’ Compensation Insurance Covers

- Medical expenses for employees injured on the job

- Lost wages while the employee is unable to work

- Rehabilitation costs for injured employees

Why it’s Mandated in Many States

Workers’ compensation insurance is mandated in many states to protect both employees and employers. It ensures that injured workers receive the necessary medical care and compensation without having to file a lawsuit against their employer. Additionally, it helps protect businesses from costly legal battles and potential financial ruin.

Potential Consequences of Not Having Workers’ Compensation Insurance

- Legal penalties and fines for non-compliance

- Lawsuits from injured employees seeking compensation

- Financial burden from paying out-of-pocket for medical expenses and lost wages

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is crucial for certain professions within an LLC. This type of insurance protects businesses and individuals from bearing the full cost of defending against a negligence claim made by a client.

Purpose of Professional Liability Insurance

Professional liability insurance is essential for professions such as doctors, lawyers, consultants, and other service-based industries. It provides coverage for claims of negligence, errors, or omissions that may arise during the course of providing services to clients.

- Doctors: In the medical field, a misdiagnosis or surgical error could result in a malpractice lawsuit. Professional liability insurance helps cover legal fees and damages in such cases.

- Lawyers: If a lawyer fails to meet deadlines or provides incorrect legal advice, they could face a professional liability claim. This insurance safeguards them from financial losses.

- Consultants: Consultants offering advice or recommendations that lead to financial losses for a client may be sued for negligence. Professional liability insurance is vital in such situations.

Scenarios Where Professional Liability Insurance is Crucial

Professional liability insurance is crucial when a client claims that the services provided did not meet their expectations or caused them harm. For example, if a financial advisor makes an error in managing a client’s portfolio resulting in significant losses, the client may file a lawsuit alleging negligence.

In such cases, professional liability insurance can cover legal expenses, settlements, or judgments.

Difference from General Liability Insurance

Professional liability insurance specifically covers claims related to professional services rendered, such as errors, omissions, or negligence. On the other hand, general liability insurance protects against bodily injury, property damage, and advertising injury claims. While general liability insurance is essential for all businesses, professional liability insurance is crucial for professions where errors or mistakes in services can lead to substantial financial losses for clients.

Wrap-Up

Summing up our discussion on the types of business insurance crucial for an LLC, it becomes evident that having the right coverage can safeguard your business against unforeseen risks and liabilities, ensuring its long-term success.

User Queries

Is Workers’ Compensation Insurance mandatory for an LLC?

Yes, in many states, workers’ compensation insurance is required by law for LLCs that have employees.

How does Professional Liability Insurance differ from General Liability Insurance?

Professional liability insurance covers errors or negligence specific to professional services, while general liability insurance covers a broader range of accidents and injuries.

Why is Property Insurance important for an LLC?

Property insurance protects business assets such as buildings, equipment, and inventory from damages due to fire, theft, or other covered events.